What is the GST Composition Scheme?

GST composition scheme is a tax payment system offered to small businesses. Under this scheme the gst is made convenient and clear for taxpayers. Small businesses can avoid time-consuming gst formalities by paying the gst at a fixed rate of 1% to 6%% according to the turnover of the business. Compared to normal GST filing the composite scheme reduces the filing work, For instance normal GST scheme involves monthly filings whereas a composite scheme is involved in quarterly filings. Thus the filing work is simple and easier for GST composite schemes.

Who can opt for a composite scheme?

It is optional and voluntary for a business to get registered under a composition scheme. Business can opt a composition scheme if their annual turnover of the business is less than 1.5 core if the business does not match the threshold limit then they become ineligible for getting registered under the scheme and they automatically have to get their business under regular GST scheme. The below are some other terms and conditions to opt composition schemes

- Businesses which deal with manufacture and supply of goods can opt for composition schemes.

- Business houses who do their business within the state can opt for composition schemes.

- Businesses who don’t sell their goods on online platforms like flipkart and amazon can opt composition schemes.

Who cannot opt for composition schemes?

The below are the following businesses which can’t opt composition schemes.

- Any business house which is involved in the service industry cannot opt for a composition scheme. Other than restaurants not serving alcohol.

- Business engaged in interstate supply of goods.

- Businesses who sell their products via an e-commerce platform.

- Supplier of tobacco, pan masala, and ice cream.

- Supplier of non-taxable goods

What are the rules to be followed by a business registered under composition scheme?

- Inter-state supply of goods shouldn’t take place.

- Input tax credit can’t be claimed by a business registered under composition scheme.

- If an individual PAN is registered for different segments of business(like electronic, software, textile, etc.) all those businesses have to opt for a common scheme either composition scheme or regular one.

- Any business registered under composition scheme must mention the word “composition taxable person” in each and every invoice raised.

- The word “composition taxable person” has to be mentioned on all the sign boards and posters of the business house.

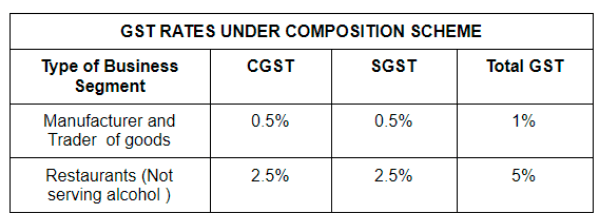

What are the tax rates for businesses who have opted for composition schemes?

Once a business opts composition scheme a fixed tax rate is applied for the turnover of the business. The below chart elaborates the tax rate according to the segment of the business.

Features of GST Composition Scheme

The below are the main features of GST Composition scheme

- Not Eligible for Input Tax Credit

- Fixed Tax Rate

- GST only on Taxable supplies

- Voluntary Registration

- No tax invoice only bill of supply

- Quarterly Filing Returns

- No Intra- State Supplies

What are the filings to be done for a registered business under composition scheme?

A business registered under composition scheme has to do the filings on 18th of the month of succeeding every quarter end. Annual return has to be filed for every financial year. Henceforth totally 5 filings have to be done on an annual basis. CMP-08 is the form used to file the quarterly filings and it even acts as a challan for making payment of tax.

How does a composition opted business pay GST?

GST must be paid out of pocket for the supplies made. The gst tax has to be borne by the taxpayer. A composition dealer’s GST charge consists of the following items:

- GST on supplies made.

- Tax on reverse charge.

- Tax on purchase from an unregistered dealer.

Can a composition GST registered business issue a tax invoice?

As they are not permitted to collect tax from their customers. A tax invoice cannot be issued by a composition seller. The composition dealer would pay the GST out of pocket. So for the collection of the charges, the composition opted business has to raise the bill of supply. At the top of the Bill of Supply, the composition opted business has to state “composition taxable person, not eligible to collect tax on supplies”.

What are the benefits of the Composition Scheme?

There is less compliance involved:

One of the most significant and promising advantages of the composition system is that it needs less compliance. In other words, the taxpayer who chooses the composition scheme is liable to less GST compliance. Since GST is a new taxation law, much of the taxpayer’s time and money is spent on filing GST returns; however, this is reduced in the case of compliance.

A business registered under the composition scheme is only needed to file 5 returns in whole (i.e. 4 quarterly return in form GSTR 4 and one annual return in form GSTR 9A). The regular registered individual, on the other hand, is expected to file monthly returns.

Lesser Tax:

Low tax rates are available to taxpayers who are enrolled under the GST composition scheme. The government specifies separate rates for taxpayers who want the composition system, and the rates listed are comparatively very low in comparison to the regular GST rates.

Low taxation and high liquidity:

Since opting for the composition scheme results in less tax payment, as mentioned above, there would be less amount of working capital blocked in tax payment, resulting in high liquidity for small taxpayers, which can be beneficial in expanding the company.

Disadvantages of Composition Scheme

Inter-State sale not permitted:

The biggest drawback to the composition system is that taxpayers who opt for it are restricted from selling interstate. These restrict them from expanding their business.

Input Tax Credit is not available:

The business house which has opted for a composition scheme cannot claim input tax credit. Even the buyer of this business can’t claim the tax credit.

Service providers are not eligible:

Taxpayers who provide services (other than restaurant-related services) are not eligible for the composition scheme.

Tax collection is not permitted:

A taxpayer who chooses the composition scheme is not permitted to collect any tax from the purchaser of his products. In fact, the composition scheme dealer is not permitted to generate tax invoices. The taxpayer is solely responsible for the tax payable under the composition scheme.

Non-eligibility to Supply Goods via an online portal

The taxpayer is not eligible for selling goods through any online portal which restricts him from expanding his business.