In recent times, there has been a rising passion for baking and chocolate making. Imagine transforming that passion into a thriving business. Starting a homemade chocolate business in India can be both fulfilling and profitable. However, before delving into the world of chocolates, you must follow some essential steps, including obtaining an FSSAI licence for homemade chocolate. In this guide, we will answer “How to start a homemade chocolate business in India?” and also to secure the necessary FSSAI licence.

Homemade Chocolate Business Plan

Draft a detailed business plan that outlines your chocolate-making process, target market, pricing strategy, and financial projections. With a solid business plan in place, you can set yourself up for success. Here’s a step-by-step guide to help you get started:

Research and Market Analysis:

- Begin by conducting thorough market research. Understand your target audience and their preferences.

- Analyse your competitors, both local and online, to identify gaps in the market.

- Determine the types of chocolates and flavours that are in demand.

Define Your Niche:

- Decide on your unique selling proposition. What sets your homemade chocolates apart from others?

- Consider specialising in a niche, such as artisanal chocolates, organic ingredients, or personalised packaging.

Legal Requirements:

- Register your homemade chocolate business as a legal entity, such as a sole proprietorship, partnership, or private limited company.

- Obtain all necessary licences and permits, including an FSSAI licence for food safety compliance.

Business Plan:

- Create a detailed business plan that outlines your business goals, target market, pricing strategy, and financial projections.

- Define your startup budget, considering expenses for ingredients, packaging, equipment, and marketing.

Sourcing Ingredients:

- Establish relationships with reliable chocolate, nuts, fillings, and other ingredient suppliers.

- Ensure your ingredients meet quality and safety standards.

- Cocoa

- Various dairy-based ingredients

- Approved artificial flavourings used in chocolate production

- Various types of sweeteners

Production Setup:

- Set up a clean and organised kitchen space for chocolate production.

- Invest in essential equipment, such as tempering machines, moulds, and refrigeration. Essential tools and machinery include:

- Weighing scales

- Cutting tools

- Chocolate melting devices

- Spinning machines

- Equipment for tempering, spinning, and coating

- Moulds

- Refrigeration units

- Packaging materials

Branding and Packaging:

- Create an appealing brand name, logo, and packaging that reflects the quality of your chocolates.

- Invest in eco-friendly and attractive packaging options.

Pricing:

- Calculate your pricing carefully, considering ingredient costs, production time, and profit margins.

- Pricing strategies also depend on competitor’s pricing.

Marketing and Promotion:

- Develop a strong online presence through a website and social media profiles.

- Use platforms like Instagram and Facebook to showcase your chocolates and engage with potential customers.

- Consider offering samples to local businesses or at food fairs to gain exposure.

Location Selection:

By carefully selecting the right location for your homemade chocolate business, you can optimise production, customer reach, and overall business efficiency. Your chosen location should align with your business model and growth plans.

- Consider the accessibility to suppliers and ease of ingredient sourcing when choosing a location.

- If you opt for a retail store, assess the visibility and accessibility of the location to attract customers.

- Home-based businesses should have adequate storage space for ingredients, packaging materials, and finished products.

- Ensure that your chosen location complies with local zoning and health department regulations for food businesses.

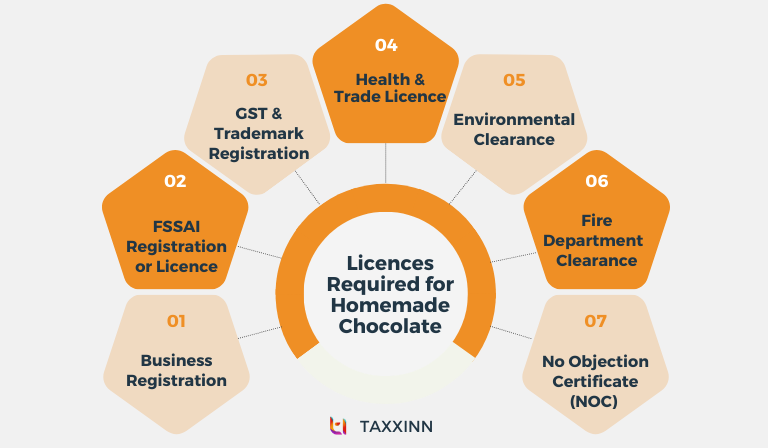

Licences and Permission Required for Chocolate Manufacturing

Starting a homemade chocolate business in India requires several licences and permissions. It’s essential to research and understand the specific licences and permissions required for your location and business scale. Compliance with these regulations will help you avoid legal issues and build a trustworthy brand in the homemade chocolate market. Here are the key licences and permissions you need:

Business Registration:

Register your homemade chocolate business as a legal entity, such as a sole proprietorship, partnership, or private limited company. This step is essential for taxation and legal compliance.

FSSAI Licence for Homemade Chocolate

The Food Safety and Standards Authority of India (FSSAI) licence is mandatory for any food-related business, including homemade chocolate production. You need to obtain either a basic FSSAI registration or a state or central FSSAI licence, depending on the scale of your business.

- Basic Registration – If your annual turnover is up to 12 lakhs.

- State FSSAI Licence – If your annual turnover exceeds 12 lakhs but doesn’t exceed the 20 crore limit.

- Central FSSAI Licence – If your annual turnover exceeds 20 crores.

Labelling Requirements for Vegetable Fat

The FSSAI has established clear guidelines concerning labelling. If vegetable fat is used in the chocolate, it must be mentioned in the product’s packaging specifications.

GST Registration:

If your annual turnover exceeds the GST threshold limit, you must register for Goods and Services Tax (GST) as a regular taxpayer.

Health Licence:

Depending on your location, you may need a health or hygiene licence to ensure your kitchen and production area meet health and safety standards.

Trade Licence:

Obtain a trade licence from your local municipal authority to legally conduct business in your area.

Fire Department Clearance:

If you’re operating from a commercial space, you may need clearance from the fire department to ensure your premises are safe.

No Objection Certificate (NOC):

If you’re operating from a residential area, obtain a NOC from your neighbours and local authorities.

Environmental Clearance:

If your production process generates waste or pollution, you may need environmental clearances or permissions.

Trademark Registration:

Consider registering your brand or logo as a trademark to protect your unique chocolate products from imitation. Trademark registration is important for any new business.

Conclusion

Obtaining an FSSAI Licence for Homemade Chocolate is not just a legal requirement but a mark of trust and quality that can set your homemade chocolate business on the path to success in India. Throughout this comprehensive guide on How to Start a Homemade Chocolate Business in India, we’ve explored the business plan, marketing strategy and necessary licences. Get in touch with Taxxinn if you need legal help to start a business in India.

Related Reads,

Start a Cafe/Coffee Shop in India.

Become A DSC Partner/Reseller.