In India fashion, beauty and cosmetic industry is at it’s peak. So, many entrepreneurs who are passionate about beauty and cosmetics are starting to run beauty parlours or salons in India. Starting a beauty parlour or salon business involves certain legal formalities that you need to navigate, like any other business. In this comprehensive guide, we’ll give a detailed answer to “How to Start a Beauty Parlour/saloon?” and walk you through the essential steps to get your beauty parlour or salon started.

Beauty Parlour/Salon Types

A salon or beauty parlour can be categorised into various business types based on which aspect of the beauty industry you choose to focus on either a specific service or offering a comprehensive range of services. Your choice depends on the specific services you intend to provide to your customers.

1. Spa centre

2. Reflexology centre

3. Barbershop

4. Wellness centre

5. Traditional beauty parlour or salon

6. Hair and skin clinic

7. Cosmetology centre, and more.

Business ownership Structure

In the beauty salon industry, choosing the right ownership structure is pivotal, and one of the most popular choices is a sole proprietorship. Each model offers distinct advantages and legal implications, so it’s vital to weigh these factors carefully before starting your entrepreneurial journey in the beauty and salon industry.

Independent Beauty Parlour:

- In this setup, an individual entrepreneur or a group of entrepreneurs operate a beauty parlour in a local neighbourhood.

- This model stands out due to its low initial investment and operational expenses.

- However, independent parlours now face fierce competition from well-advertised beauty chains.

- For this model, consider establishing a Limited Liability Partnership (LLP) or a One Person Company (OPC).

Franchise Beauty Parlour:

- Under this model, the parlour functions as a franchisee of a renowned beauty parlour chain.

- The franchisor provides substantial support, covering aspects like salon setup, operations, staff training, branding, and advertising.

- Be prepared for a higher investment compared to an independent establishment, including initial setup costs and revenue-based franchise fees.

- Beauty Parlour Franchise Cost

- 0% royalty for the first 3-6 months (depending on the agreement).

- 10% to 15% in the following 3-6 months, with possible variations based on the agreement.

- 15% or more once the franchisee starts generating profits.

- Establishing your beauty salon franchise as an LLP or a private limited company offers advantages, including ease of transferring rights and assets.

Franchisor of a Beauty Parlour Chain:

- When planning to operate multiple beauty salons under centralized management, you’re entering the domain of salon chains.

- Establishing a chain of successful beauty parlours could eventually lead you to become a franchisor of a beauty parlour chain.

- This endeavour demands substantial capital, meticulous planning, vendor collaborations, branding, advertising, and more.

- Given that your brand name becomes your most valuable asset in this model, it’s crucial to secure trademark registration for your brand from the outset.

- Entities like private limited companies or limited companies are ideal choices for setting up a chain of beauty parlours or becoming a beauty parlour franchisor.

How to Start a Beauty Parlour/Salon Business – Business Plan

Step 1: Business Entity and Registration

Before getting started in the beauty industry, you must decide on your business structure. Most commonly, beauty parlours or salons in India operate as Sole Proprietorships, Partnerships, Limited Liability Partnerships (LLPs), or Private Limited Companies. Each structure has its own legal requirements and tax implications.

Sole Proprietorship: This is the simplest form of business ownership, where you are the sole owner and responsible for all business operations. You may need to register your business under the Shops and Establishments Act.

Partnership: If you plan to have a partner, you can form a partnership. Ensure you draft a partnership deed specifying the rights and responsibilities of each partner.

LLP or Private Limited Company: These structures offer more legal protection and tax benefits, but the registration processes with the Ministry of Corporate Affairs(MCA) can be complex compared to the others.

Step 2: Location and Premises

Selecting the right location for your beauty parlour or salon is crucial. Ensure that the premises comply with local zoning regulations and have the necessary licences for commercial activities.

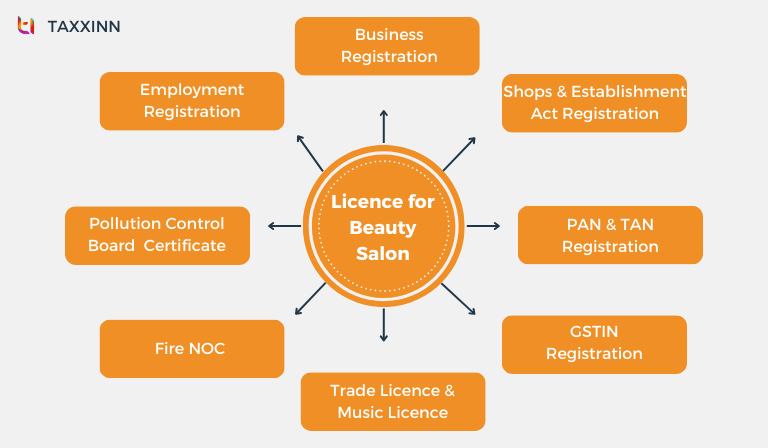

Step 3: Permits and licences for Beauty Parlour

To operate legally, you will need several licences and permits, including:

Shop and Establishment Licence, GST Registration, Trade Licence, and Fire Safety Licence.

Step 4: Health and Safety Compliance

As a beauty parlour or salon owner, you must adhere to health and safety regulations to protect your clients and staff. This includes maintaining hygiene standards, sterilizing equipment, and ensuring proper ventilation.

Step 5: Employment and Labor Laws

If you plan to hire employees, familiarize yourself with labour laws in India, such as minimum wages, working hours, and employee benefits. Ensure you have proper employment contracts and adhere to all legal requirements.

Step 6: Intellectual Property Rights (IPR)

If you plan to use unique branding, logos, or product formulations, consider obtaining a trademark for your intellectual property to prevent others from using it without your permission.

Beauty Salon Licence Requirements

Business Registration

The first step in establishing any business involves choosing the appropriate legal structure, which could be a Partnership Firm Registration, a Private Limited Company, a Limited Liability Company, or a Sole Proprietorship. If you opt for a corporation or LLP, you must register it with the appropriate authority. Partnership firms usually complete this registration at the sub-registrar’s office, whereas sole proprietorships involve fewer formalities.

Shops and Establishment Act Registration

You must acquire a Shops and Establishment licence within 30 days of commencing your business. This registration is essential before you can operate your shop or establishment, conduct business activities, or hire employees. The Act outlines various regulations concerning opening and closing times, working hours, overtime policies, leave entitlements, work distribution, and notice display requirements.

PAN and TAN Registration

Every business entity must obtain a Permanent Account Number (PAN) and a Tax Deduction and Collection Account Number (TAN) in their name. However, in the case of a sole proprietorship, these numbers can be issued in the owner’s name. Both PAN and TAN are unique ten-digit alphanumeric identifiers issued by the Income Tax Department. PAN is required for transactions exceeding ₹50,000, while TAN is essential for tax deduction at source (TDS).

GSTIN Registration

If your business’s annual revenue exceeds ₹10 lakhs in North Eastern and special category states or ₹20 lakhs in other states, you must register for the GST Identification Number (GSTIN). GSTIN is a unique ten-digit alphanumeric identifier issued by the Income Tax Department, necessary for making payments exceeding ₹50,000 and for TDS deduction.

Trade Licence

Before commencing your business, you must obtain a trade licence from the local administration, which ensures your business complies with legal and public policy requirements. Your trade licence application should include various documents, such as company/firm registration papers, property tax documents, fire NOC, ID proof, and address proof.

Fire NOC

Depending on your business’s location, type, and operations, you may require a No-Objection Certificate (NOC) from the Chief Fire Officer. For instance, if your business involves customer visits and on-site employees, you must obtain a fire NOC. Additional documents, including building designs, architectural certificates, and lists of electrical appliances, may be required along with your application.

Pollution Control Board (PCB) Certificate

If your boutique generates bio-waste, which often occurs in salons due to hair and nail treatments, along with chemical waste, you may need a Pollution Control Board (PCB) certificate, as this falls under the category of an industry. The PCB will issue a licence after reviewing your documents and, if necessary, conducting on-site inspections.

Employment Registration

ESI Online Registration (ESI) is mandatory if you employ 20 or more individuals on a salary basis. Under this program, employees earning less than ₹21,000 per month are eligible for benefits.

Music Licence

If you are planning to play pre-recorded music in the beauty parlour/salon you need to get a public performance licence issued by Phonographic Performance Limited.

Beauty Parlour/Salon Marketing

Marketing is a crucial aspect of running a successful beauty salon. Effective marketing strategies can help you attract new clients, retain existing ones, and ultimately grow your business. Here are some key marketing tips for beauty salons:

- Build an Online Presence

- Leverage Online Reviews

- Email Marketing

- Professional Branding

- Collaborate with Influencers

Government Schemes for Beauty Parlours/Salons in India

The Indian government provides several schemes and initiatives that can greatly benefit beauty parlours and salon businesses. These programs are designed to offer financial support, promote skill development, and provide additional resources to entrepreneurs operating in the beauty and wellness sector.

- Bharatiya Mahila Bank – Shringaar

- Orient Mahila Vikas Yojana Scheme

- Pradhan Mantri Mudra Yojana (PMMY)

- Startup India Scheme

These are just a few examples, as numerous other schemes in India help women entrepreneurs in this industry.

Conclusion

This blog clearly explains the “How to start a beauty parlour/salon?” Starting a beauty parlour or salon business in India involves several legal formalities. Seeking legal guidance and support, such as that provided by Taxxinn, can be invaluable in ensuring that you meet all legal requirements and operate your business smoothly and compliantly. Our team will help you with business registration and all the licencing processes.

Related Reads,

How To Become A DSC Partner/Reseller?

How to Start a Coaching Institute/Tuition in India?

List of Licences and Registrations Required for Hotel Business?