The Indian government established the Startup India initiative on January 16, 2016, to aid entrepreneurs with funding and guidance. Its goal is to boost the nation’s economy, support and inspire businesses, and attract dynamic entrepreneurs.

It also provides business owners with opportunities to network with industry leaders, investors, and other key figures. The program further promotes technology transfer, research, and development within the country. This initiative fosters economic growth and creates more job opportunities nationwide.

If your business thrives on creativity, consider opting for Startup India Registration Services. This article will walk you through the concept of startup India registration eligibility, the process, and the benefits.

Startup India Registration Eligibility Criteria

- The business must have been incorporated as a limited liability partnership, a private limited company, or a partnership firm.

- The Indian Patent and Trademark Office was intended to provide the company with a patron guarantee.

- The business has to be brand-new or no older than five years, and it cannot have yearly revenue greater than Rs. 25 crores.

Benefits of the Startup India Scheme

- Startups registered under the Start-Up India scheme enjoy a three-year tax exemption.

- The government and public sector undertakings (PSUs) simplify their regulations for startups through various tenders, allowing them to participate in public auctions.

- The government has allocated Rs 10,000 crore for investments in startups, managed by SIDBI. Any startup can apply to access this funding.

- To encourage entrepreneurs, the government regularly launches various programs.

- Startups also benefit from building networks and seeking connections. They often seek mentorship from larger corporations to aid their growth.

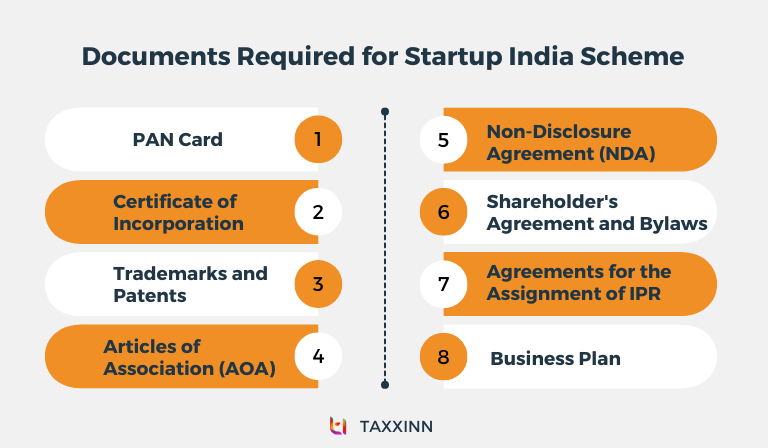

Documents Required for Startup India Registration

- Complete profile authentication data for the director.

- PAN Card: Essential for public speaking events, startup development, or stage startups. You’ll also need proof related to your main website, affiliates, or presentation slides.

- Certificate of Incorporation: This document provides details about your company’s legal incorporation.

- Trademarks and Patents: Include information on any trademarks or patents associated with your business.

- Articles of Association or Incorporation: This should also cover any trademarks.

- Non-Disclosure Agreement (NDA): If applicable, provide a copy of your NDA.

- Shareholder’s Agreement and Bylaws: Include these documents if they are relevant to your business structure.

- Agreements for the Assignment of Intellectual Property: If you have agreements related to intellectual property, include them.

- Business Plan: Your business plan outlines your company’s goals and strategies.

How to Register a Startup Company in India?

The Startup registration process involves several steps:

Business Incorporation

If your business is not structured as a sole proprietorship, it should be registered as a Limited Liability Partnership, Private Limited Company, or Registered Partnership Firm. These business structures do not require additional registrations under Startup India.

Create a User Account

Once your company is incorporated, create a user account on the Startup India Portal. This is the first step in obtaining a Startup India Certificate. Afterwards, you can log in to the Startup Portal to set up your business and apply for DPIIT recognition.

Fill out the Form

After logging in, you’ll find a button to request an acknowledgement certificate. Select your corporate entity, provide your company information, and submit the form.

Self-Certify

During the startup registration process, you must prove that your business meets specific criteria, including:

- It wasn’t formed by splitting or re-establishing an existing company.

- It is privately funded or bootstrapped.

- Indian promoters control the majority of shares.

- It’s not a joint venture.

- It operates as a distinct entity.

You’ll also need to submit supporting documents alongside your self-certification.

Upload Documents

The required documents for startup registration include:

- Certificate of Incorporation or Registration.

- Proof of funding (if applicable).

- Authorisation letter from the authorised representative of the corporation, LLP, or partnership firm.

- Proof of concept (pitch deck, website link, or video) for startups in validation, early traction, or scaling stages.

- Details of patents and trademarks.

- List of awards or certificates received.

- PAN Number.

Obtain the Startup India Certificate

After submitting the form and necessary documents, the DPIIT will review your application. If it’s error-free, the DPIIT will issue a Recognition number and the DPIIT registration certificate within 4 to 5 working days.

Certificate Delivery

The Startup India recognition certificate will be sent to the authorised representative’s email address. With this certificate, you can start applying for additional benefits under the Startup India program, such as angel tax exemption and section 80 IAC tax exemption.

GST/Tax Exemption Under Startup India

80 IAC Tax exemption

After receiving acknowledgement, a Startup has the option to request Tax exemption under Section 80IAC of the Income Tax Act. Once Tax exemption is approved, the Startup becomes eligible for a tax holiday lasting three consecutive financial years within its initial ten years of incorporation.

Eligibility criteria for applying for Income Tax exemption (80IAC):

- The entity must hold official recognition as a Startup.

- Only Private Limited or Limited Liability Partnership entities are qualified for Tax exemption under Section 80IAC.

- The startup must establish itself after April 1, 2016.

Section 56 of the Income Tax Act (Angel Tax)

After receiving acknowledgement as a Startup, it is eligible to seek Angel Tax Exemption.

Eligibility criteria for Tax Exemption under Section 56 of the Income Tax Act:

- The entity must hold recognition from DPIIT as a Startup.

- The total paid-up share capital and share premium of the Startup, after the intended share issuance (if any), must not surpass INR 25 Crore.

Conclusion

Lately, startups in India have been receiving significant support from the government, which has led to a growing number of Indians starting businesses. We hope this article helps you to understand the startup India registration eligibility, process, documents and tax exemptions. At Taxxinn, we’re here to guide you through every step, from business incorporation and documentation to setting up your startup company.

FAQ’S

1) Who Can Register with Startup India?

To register with Startup India, your business must be either a limited liability partnership, a private limited company, or a partnership firm. It should be newly established or not more than five years old, with annual revenue not exceeding Rs. 25 crores.

2) Who Can’t Join the Startup India Programme?

Public limited companies and sole proprietorships are not eligible for registration under the Startup India programme.

3) What Are the Benefits of Joining an Indian Startup?

Entrepreneurs looking to kickstart their ventures can gain numerous advantages through the Startup India Initiative. However, to avail of these benefits, a business must first select DPIIT as its starting point.

4) Can Foreign Companies Register with the Startup India Scheme?

Any company with at least one registered office in India can participate in the scheme, although the location preferences are currently limited to Indian states.

5) How Do Incubators and Accelerators Differ?

Incubators, typically organisations with expertise in IT and business, focus on nurturing startups and helping them grow, especially in their early stages.

Related Reads,

What Are the Tax Exemptions to Startups by the Indian Government and Eligibility to Claim?

Start a Cafe/Coffee Shop in India.